BDO Flash Alert: Personal Income Tax – Domestic Shopping of the year 2023 (“Shop Dee Mee Khuen”)

BDO Flash Alert: Personal Income Tax – Domestic Shopping of the year 2023 (“Shop Dee Mee Khuen”)

The government has approved a personal income tax deduction of up to THB 40,000 for certain purchases of goods and services from 1 January 2023 to 15 February 2023. The purchase must be supported by a proper tax invoice under the Value Added Tax (“VAT”) regulations, except if the vendor is a non-VAT registered business operator engaged in the business of selling books, electronic books (e-books), or One Tambon One Product Program (“OTOP”) products from shops registered with the Community Development Department.

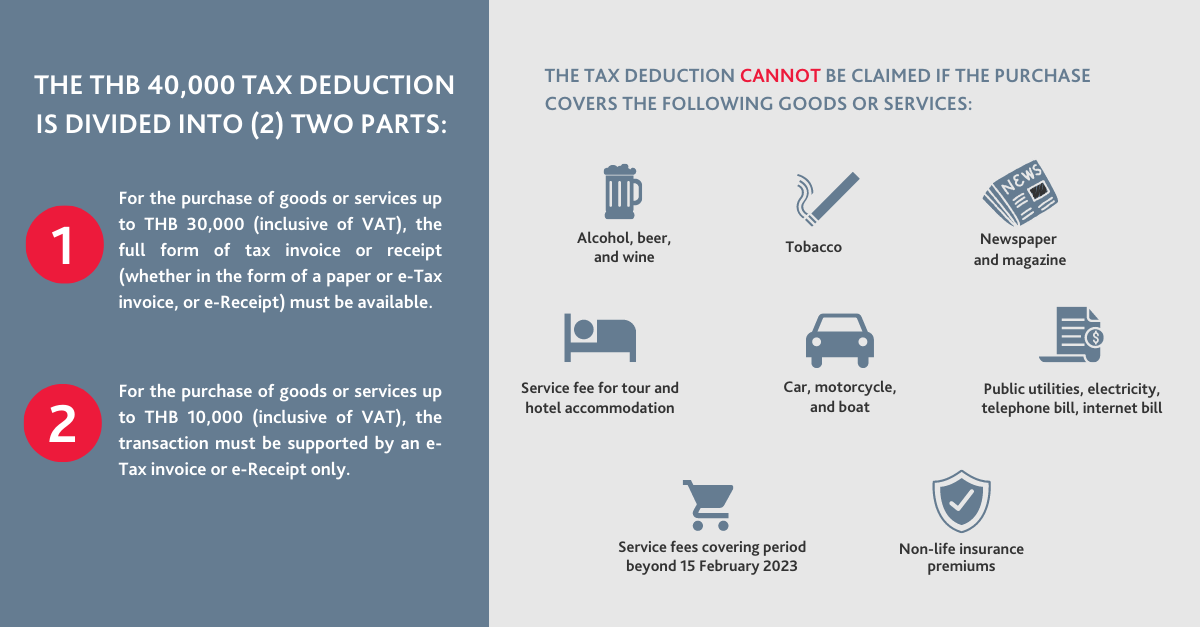

The THB 40,000 tax deduction is divided into two (2) parts:

- For the purchase of goods or services up to THB 30,000 (inclusive of VAT), the full form of tax invoice or receipt (whether in the form of a paper or e-Tax invoice, or e-Receipt) must be available.

- For the purchase of goods or services up to THB 10,000 (inclusive of VAT), the transaction must be supported by an e-Tax invoice or e-Receipt only.

The tax deduction cannot be claimed if the purchase covers the following goods or services:

- Alcohol, beer, and wine

- Tobacco

- Car, motorcycle, and boat

- Newspaper and magazine (both paper and electronic)

- Service fee for tour and hotel accommodation

- Public utilities, electricity, telephone bill, internet bill

- Service fees covering period beyond 15 February 2023

- Non-life insurance premiums

BDO Insight:

- This is the first year that the spending on fuel for cars and motorcycles is allowed as a tax deduction.

- The name and tax ID number of the taxpayer indicated on the full form of a tax invoice or receipt must be accurate.

- For the purchase of books, electronic books (e-books), or OTOP products from a non-VAT registered shop, the receipt must include the following information:

- The name and surname of the taxpayer

- The tax ID number of the vendor

- The name or brand of the vendor

- The serial number of the book and the relevant receipt

- The issuance date of the receipt

- The amount paid on the transaction

- The type, name, amount, and price in case the price of the goods is THB 100 or more.

- The e-Tax invoice or e-Receipt must be issued by shops duly approved by the Revenue Department (The list is available here).

- The THB 40,000 spending is an allowable tax deduction, not a tax refund. Please see the effective tax benefit rates below:

Accordingly, if you have a net income of THB 600,000, your top rate is 15%. For a domestic spending of THB 40,000, the effective tax rate benefit is THB 6,000.

Issuances related to the tax deduction:

- Director General Notification No. 431 issued under the Revenue Department of Thailand

- Ministerial Regulations No. 386 (year 2022) issued under the Revenue Code on tax exemption.